The debate on the withholding tax incidence on import of shrinkwrapped software continues. I wonder when this will end. In India's Silicon Valley, as Bangalore tends to be called, this debate is very much alive.

To read more, click here.

Or scroll down for the article extracted from The Economic Times online.

The issue is not shrinking

LUBNA KABLY

[ FRIDAY, NOVEMBER 24, 2006 12:00:00 AM]

Normally, I scoff at self-help books. Yet, when I was gifted a book, Naked in the Boardroom, authored by legendary media executive Robin Wolaner I devoured it in one sitting. In fact, I have even memorised some of the ‘naked truths’ outlined in this book. One of them is: “Before worrying overly about your job’s lack of challenge and certainly before complaining about it, concentrate on delivering.” I have held quite a few jobs in the past, ranging from working in a media-house, a law firm and a few CA firms. Each one of them has been challenging and interesting. Yet, I have had reason to complain off and on. After all, tax was the common theme in all these jobs and tax issues often leave one with no other option but to complain and gain sympathy from fellow sufferers.

Let me begin with a question. What is the difference between a copyright and a copyrighted product? The answer is simple. If the buyer has the right to commercially exploit a product by making multiple copies of it and reselling it, he or she has purchased a copyright. On the other hand, if the buyer simply has the right to use it, the buyer has purchased a copyrighted product. When I walk into my favourite bookstore and purchase a book, all I am buying is a copyrighted product. I do not have the legal right to photocopy this book and sell it on the pavement.

Recently, a decision by the Authority for Advance Rulings (AAR) has once again thrown open for debate, the issue of whether tax needs to be withheld at source in India on import of software. This matter had been more or less put to rest. The Bangalore tribunal in the case of Samsung Electronics, a landmark decision, which was reported promptly by this paper, had held that payments made by an Indian company to a foreign company for import of shrink wrapped (off-the-shelf) software are not in the nature of royalties, since what the Indian purchaser has acquired is only a copy of the copyrighted product. Several similar judicial pronouncements were made by various tax tribunals. If the payment gets classified as royalty, then the foreign supplier is subject to withholding tax in India. Else, if such foreign supplier of shrink wrapped software does not have a fixed place of business in India there is no tax liability in India.

If one interprets a recent ruling of the AAR in the case of Headstart Business Solutions, it appears that a debate may spark off again. The applicant had in its submission to the AAR contended that as the purchase of software did not entail transfer of a copyright, there was no element of royalty. However, the AAR held that the question raised by the applicant on whether tax needs to be withheld at source, did not require an examination of the nature of payment or finding whether any element of income arose in India for the purpose of taxation under the Income-tax Act, 1956 (I-T Act).

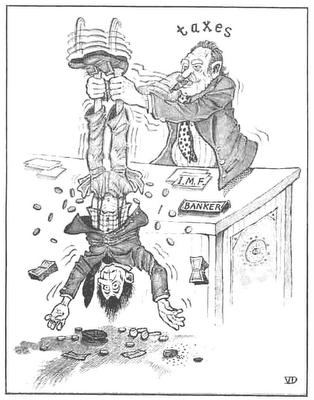

Under section 195 of the I-T Act, any person paying to a non-resident, any sum chargeable under the provisions of the Act is required to deduct tax at the applicable rates. There is some confusion now on whether the payer should play it safe and withhold tax at source prior to making payment to the foreign supplier, even if the belief is that such payment is not royalty and therefore not chargeable to tax in India.

The rulings given by the AAR do not set a precedent; they are binding only on the applicant and the tax authorities in relation to the transaction for which the ruling was sought. However, these rulings still have persuasive value in the course of tax assessments.

While we dream of making some of our cities the next Singapore, perhaps we do need to borrow a leaf from its tax laws. Way back in November 2000, the Singapore government announced that royalty payments made to non-residents for shrink-wrapped software will be exempt from tax in Singapore. Later, in February 2001, it was announced that in addition certain categories of software payments accruing on or after February 23, 2001 will also be exempt from tax. These categories were downloadable software for end user, site license and software bundled with computer hardware. We do need similar clarity in India. Perhaps a circular on the same lines will help.

Imposing taxes through withholding on import of shrink-wrapped software will only make genuine software that much more expensive. I am sure that the intent is not to encourage piracy, but indirectly that is precisely what the complexity in tax laws will end up encouraging. I am sure, dear readers, you now understand why I occasionally complain.

(The author is a CA. Views are personal.)